2016 showed a very challenging start for the EM markets. However, significant second quarter outperformance reversed much of the earlier weakness we saw.

In this podcast, Alger Emerging Markets Strategy Portfolio Manager Deborah Vélez Medenica gives an update on the portfolio and shares her views on current trends and themes in emerging markets.

Click here for Deborah Vélez Medenica's Bio.

|

![]()

The views expressed are the views of Fred Alger Management, Inc. These views are subject to change at any time and should not be interpreted as a guarantee of the future performance of the markets, any security or any funds managed by Fred Alger Management, Inc. These views should not be considered a recommendation to purchase or sell securities. Individual securities or industries/sectors mentioned, if any, should be considered in the context of an overall portfolio and therefore reference to them should not be construed as a recommendation or offer to purchase or sell securities.

Risk Disclosure: Investing in the stock market involves gains and losses and may not be suitable for all investors. Growth stocks tend to be more volatile than other stocks as the price of growth stocks tends to be higher in relation to their companies´ earnings and may be more sensitive to market, political and economic developments. Investing in companies of all capitalizations involves the risk that smaller issuers in which the Fund invests may have limited product lines or financial resources, or lack management depth. Special risks associated with investments in emerging country issuers include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability and different auditing and legal standards. Foreign currencies are subject to risks caused by inflation, interest rates, budget deficits and low savings rates, political factors and government controls. Some of the countries where the Fund can invest may have restrictions that could limit the access to investment opportunities. The securities of issuers located in emerging markets can be more volatile and less liquid than those of issuers in more mature economies. Investing in emerging markets involves higher levels of risk, including increased currency, information, liquidity, market, political and valuation risks, and may not be suitable for all investors.

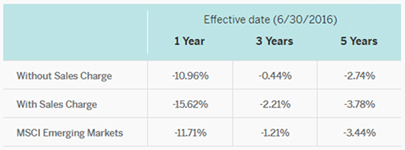

Performance quoted above is for the Class A shares of the Fund. The performance data quoted represents past performance, which is not an indication or a guarantee of future results.Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance figures assume all distributions are reinvested. Returns with a maximum sales charge reflect a front-end sales charge on Class A Shares of 5.25%. Class C Shares held less than one year are subject to a 1% contingent deferred sales charge (CDSC). Class I shares are subject to Distribution and Shareholder Fees. For performance current to the most recent month end, visit www.alger.com or call 800.992.3863.

The Morgan Stanley Capital International (MSCI) Emerging Markets Index (gross) is a free float adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Investors cannot invest directly in any index. Index performance does not reflect the deduction for fees, expenses, or taxes. Benchmark returns are not covered by the report of independent verifiers.

Morningstar percentile rankings are based on the total return percentile rank (excluding sales charge) within each Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The Alger Emerging Markets Fund Class A ranking for the 3-year period ended 6/30/16 is 192 out of 590 funds; for the 5-year period ended 6/30/16 is 159 out of 416 funds.

If sales charges were included, performance would be lower and the rank may be lower. Morningstar Rating is not to be confused with Morningstar Ranking, which is a numeric ranking of the fund, and is a distinct designation. Source: Morningstar. During certain of the referenced time periods, the Fund experienced periods of negative performance results. ©2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

As of 6/30/16, the following represents the Alger Emerging Markets Fund’s assets under management: Bb Seguridade Participacoes Sa 1.34%; Luxoft Holding, Inc. Class A 1.54%.

Alger Management, Ltd. (company house number 8634056, domiciled 78 Brook Street, London, W1K 5EF, UK) is authorised and regulated by the Financial Conduct Authority, for the distribution of regulated financial products and services. La Française AM International has a signed agreement with Alger Management Ltd, whereby La Française AM International is authorized to distribute Fred Alger Management Inc. products in Europe.

Before investing, carefully consider the Fund’s investment objective, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information about the Fund, call (800) 992-3863, visit www.alger.com, or consult your financial advisor. Read it carefully before investing. Distributor: Fred Alger & Company, Incorporated. Member NYSE Euronext, SIPC. NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Founded in 1964, Fred Alger Management Inc. provides investment advisory services to institutional and individual investors through traditional and alternative strategies in a variety of products, including separate accounts, mutual funds and privately offered investment vehicles. For more information, please visit www.alger.com.